Welcome to The Hub

Your home for the latest news & views from the Communicate Better team.

Gain inspiration, tips & tricks from the experts, and updates on upcoming events & releases.

7 Simple Ways to Save Money

Jul 13, 2020

The future is more uncertain now than ever before. And while you may have some cash tucked away for a rainy day, here are some ways you can save more money.

Here, Communicate Better rounds up 7 pretty simple tips on how you can save for all your short- and long-term savings goals.

1. Track your expenses

The first step to start saving money is to figure out how much you spend.

Keep a record of all your expenses. This will include your regular monthly expenses and other situational expenses (like a last-minute holiday or an impulse purchase).

Enter all your expenses into a budget sheet or a free spending tracker application. By recording your utility bills, groceries, fuel expenses and other bills, you will be aware of exactly where your money is going.

Once you have it all figured out, you can decide the areas from which you can cut your expenses.

2. Carry a list

Ever go to the shop for a bottle of milk and come back with a whole week's worth of shopping? Yeah, say goodbye to impulse buying.

Always make lists. When you carry a list, you won’t be tempted to pick up random stuff that you may not need at that moment.

And never shop when you're hungry! You'll be more likely to waste money.

3. Set savings goals

Always set goals. Start by thinking of what you might want to save for - perhaps you’re getting married, planning a holiday or saving for retirement. Then figure out how much money you’ll need and how long it might take you to save it.

Set short-term goals (1-3 years) and long-term goals (4+ years).

Small, achievable short-term goals can be fun but can more importantly give you a psychological boost that makes the payoff of saving more immediate and reinforces the habit.

Long-term goals may rely on you making bigger investments but will ultimately be more rewarding.

4. Decide on priorities

Yes, we'd all like a new house and car... but setting priorities is important.

This means finding a balance between short-term and long-term goals and being content with your decision.

5. Do comparative price checks

Never be afraid to compare prices before a purchase.

If you are unaware of the average prices charged for items, you risk being overcharged.

Sure, this can be time-consuming, but it’s worth it in the long run when you’re saving money. Also, keep an eye out for discount offers and seasonal sales – this can be a great money-saving opportunity.

6. Stop relying on your credit card

It’s way too easy to swipe a card even if you don’t have the cash.

To avoid overspending on a card, try to stop relying on your credit cards. Whenever you go out for some shopping, carry only the cash that you will need. That way you will be automatically driven to stay on your budget and ignore the impulse to make unnecessary purchases.

7. Use a separate bank account for savings

The amount you save every month should be kept in a separate bank account.

Keeping the savings in a separate account will make it that much harder to accidentally spend it.

Latest News

Is someone spying on my iPhone? How to stop them

Mar 21, 2022

How to tell if someone is spying on your iPhone - and how to stop them.

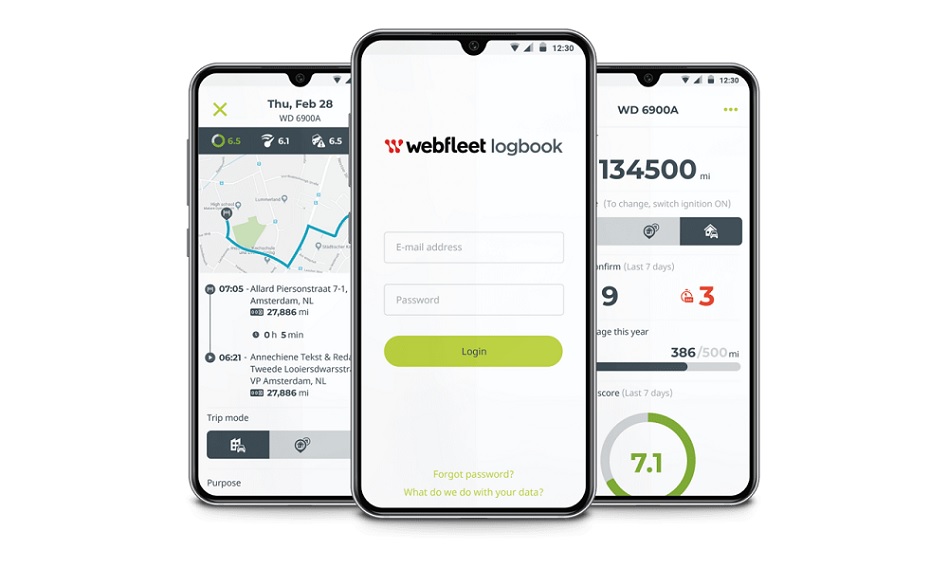

Read more5 reasons why your fleet needs a mileage logbook

Mar 16, 2022

Here is why your business needs a Webfleet Mileage Logbook.

Read more4 signs you need to upgrade to a Cloud Phone Solution

Mar 9, 2022

Is your business growing? Here's how a Cloud-based Phone Solution can help you stay ahead of the competition.

Read moreBetter solutions mean a Better business

Keen to explore what we can do for your business? Contact our team today.